FREE Income Tax Clinic

From March 20-April 29, SECC will provide free income tax preparation and e-filing for qualified individuals through Canada Revenue Agency’s Community Volunteer Income Tax Program (CVITP).

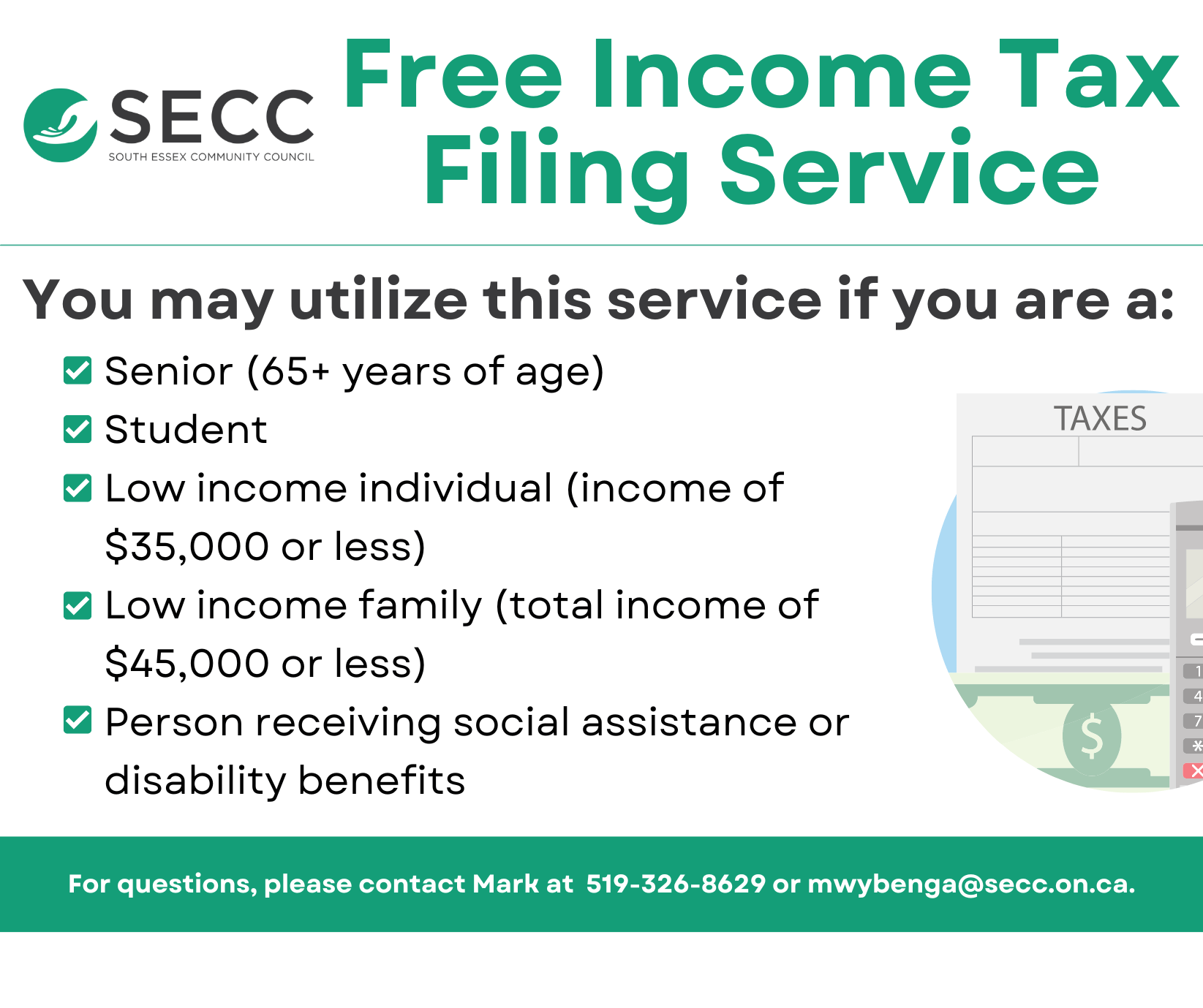

You may use this service if you are a:

- Senior (65+ years of age)

- Student

- Low income individual (income of $35,000 or less)

- Low income family (total income of $45,000 or less)

- Person receiving social assistance or disability benefits

We cannot return files containing:

- Self-employment income or employment expenses

- Business or rental income and expenses

- Interest income over $1,000

- Capital gains or losses

- Foreign property (T1135)

- Bankrupt individuals in the year of or prior to bankruptcy

- Deceased individuals

How To Use This Service

Choose your preferred method from the options below:

- IN PERSON APPOINTMENT

Call SECC at 519-326-8629 to schedule an in-person appointment and have your taxes completed while you wait.

Appointments available in both Leamington and Kingsville Offices.

- DROP-OFF

a) Place all income slips & receipts in a labelled envelope with your name & phone number - b) Complete the Income Tax Drop-Off Form at the office & attach it.

Income tax documents can be dropped off for filing at:

Leamington Office – 215 Talbot St E

Monday-Friday 8:30am-4:30pm

Saturday 8:30am-12:30pm

Kingsville Office – 313 Main St E, Unit 21

Monday-Friday 8:30am-4:30pm

*Please ensure you have received all of your tax slips before filing*

Documents & Information you need to file your taxes:

- Social Insurance Number

- Date of birth

- Marital Status

- Citizenship

- Income Slips

- Property Tax paid or Rent paid

- Medical Expenses paid out of pocket (not coverage by insurance)

- Registered Retirement Savings Plan contributions (RRSPs)

- Charitable Donations

- Tuition Fees

- Child Care Expenses (daycare or babysitting fees only)

- New Immigrants will be required to provide their date of entry into Canada

Income Slips can Include:

-

- T4– Employment Income

- T5007– Employment Insurance, Worker’s Compensation, Social Assistance, Disability Benefits

- T4A/T4A(P)/T4(OAS)/T4RIF– Retirement Income, Pension, Old Age Security

- Scholarships & Bursaries

- RRSPs

- Interest income, Annuity income, Canada’s savings bonds

For questions or additional accommodations, please contact Mark Wybenga at mwybenga@secc.on.ca or 519-326-8629 x344.

Share This Article

Choose Your Platform: Facebook Twitter Google Plus Linkedin