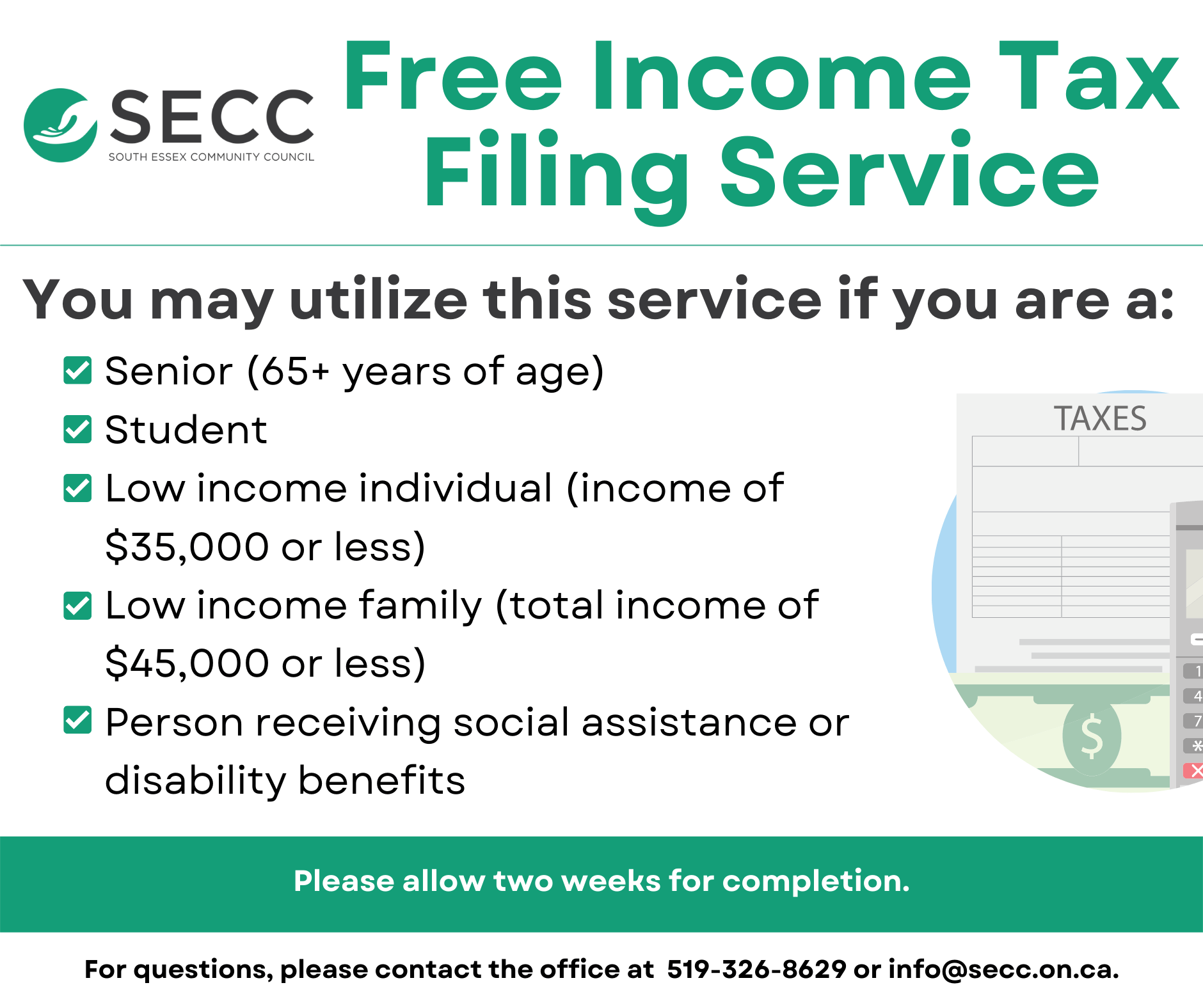

FREE Income Tax Clinic

Beginning March 14, 2022 SECC will provide free income tax preparation and e-filing for qualified individuals through Canada Revenue Agency’s Community Volunteer Income Tax Program (CVITP).

You may use this service if you are a:

- Senior (65+ years of age)

- Student

- Low income individual (income of $35,000 or less)

- Low income family (total income of $45,000 or less)

- Person receiving social assistance or disability benefits

We cannot return files containing:

- Self-employment income or employment expenses

- Business or rental income and expenses

- Interest income over $1,000

- Capital gains or losses

- Foreign property (T1135)

- Bankrupt individuals in the year of or prior to bankruptcy

- Deceased individuals

How To Use This Service:

DROP-OFF

Place all income slips & receipts in a labelled envelope with your name & phone number. Complete the Income tax drop-off form at the office & attach it.

Income tax documents can be dropped off for filing at our Leamington location (215 Talbot St E) during business hours:

Monday-Friday 8:30am-4:30pm

Saturday 8:30am-12:30pm

*Please ensure you have received all of your tax slips before filing*

Documents & Information you need to file your taxes:

- Social Insurance Number

- Date of birth

- Marital Status

- Citizenship

- Income Slips

- Property Tax paid or Rent paid

- Medical Expenses paid out of pocket (not coverage by insurance)

- Registered Retirement Savings Plan contributions (RRSPs)

- Charitable Donations

- Tuition Fees

- Child Care Expenses (daycare or babysitting fees only)

- New Immigrants will be required to provide their date of entry into Canada

Income Slips can Include:

-

- T4– Employment Income

- T5007– Employment Insurance, Worker’s Compensation, Social Assistance, Disability Benefits

- T4A/T4A(P)/T4(OAS)/T4RIF– Retirement Income, Pension, Old Age Security

- Scholarships & Bursaries

- RRSPs

- Interest income, Annuity income, Canada’s savings bonds

Please allow two (2) weeks for completion.

For questions or additional accommodations, please contact info@secc.on.ca or call 519-326-8629

Share This Article

Choose Your Platform: Facebook Twitter Google Plus Linkedin